Article

Consolidation expected in fragmented electric vehicle (“EV”) charging market

goetzpartners recently advised on M&A mandates in the electric vehicle (“EV”) charging market that – driven by climate regulation and producer commitments – is expected to grow annually by nearly 40% in Europe until 2030. Currently the market is still fragmented, and we expect several consolidation waves interesting for various investor groups ranging from strategics in the EV charging field, to private equity, infrastructure investors and large corporates in the oil & gas or utilities sectors.

Double-digit market growth needed to meet ambitious climate goals

The fight against global warming has become a key goal for governments and the public alike, with scientific evidence showing how global average temperature increases, by for example 1.5°C, will trigger irreversible climate tipping points with serious consequences for humankind.1 2

To achieve the commitments under the 2015 Paris Agreement that aims to limit temperature increases to between 1.5°C – 2.0°C (relative to pre-industrial levels), the European Union agreed to reduce its greenhouse gas emission (“GHG”) by 55% (relative to 1990) until 2030 and wants to become climate neutral by 2050 as the first continent worldwide.3

Since the transportation sector is the second largest contributor to GHG emissions,4 the European Union has put forward an emission-reducing mobility strategy targeting the operation of 30 million EVs by 2030 and the deployment of automated mobility on a large scale.5 To enable this rapid expansion, a prerequisite is the parallel build-out of the electric charging infrastructure.

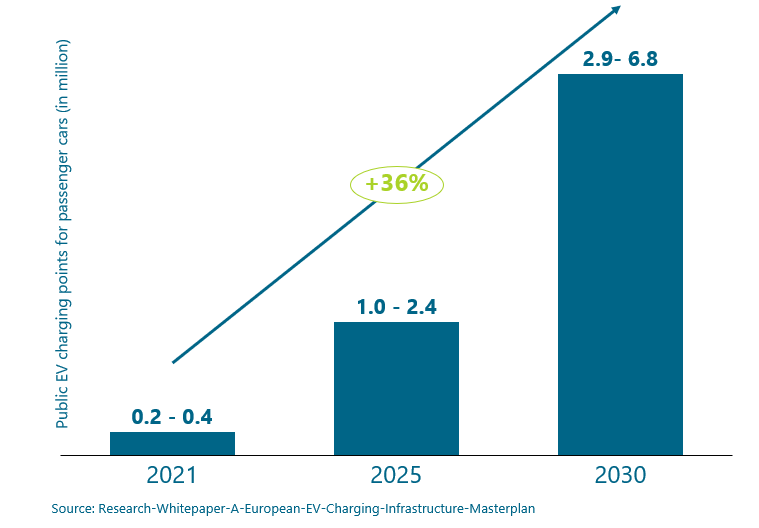

In a study conducted by the European Automobile Manufacturers’ Association (“ACEA”, 2022) it is estimated that the EU will need between 2.9 – 6.8 million public charging points in 2030 implying an annual growth rate of nearly 40% from 2021 onwards.

Figure 1: Public EV charging infrastructure for passenger cars in Europe (in million charging points)6

This built-out – also requiring utility grid updates – is expected to cost between €60 and €100 billion until 2030, demonstrating the tremendous potential for all market participants ranging from charging point operators (“CPOs”), charging equipment manufacturers to engineering and construction companies alike.

Growth supported by ambitious commitments from the oil & gas, utility and automotive sector

Producers and operators of “traditional” products and services are opting to focus on sustainable mobility and have recognized the vast market potential. For example, oil & gas companies like Shell and bp have started offering electric charging services to their customers. Shell currently has more than 40,000 public charging points globally and targets c.200,000 by 2030.7 bp aims to operate 100,000 charging points by 2030.8

Utilities are also highly active in the field with EnBW and E.ON as the leading CPOs in Germany. EnBW operates more than 3,400 fast charging points in Germany and is planning 30,000 by 2030.9 In November 2023, E.ON announced its European partnership with Mercedes-Benz that targets 10,000 fast charging points worldwide by 2030.10

Next to Mercedes-Benz also Volkswagen offers public charging and is committed to an ever increasing electric-based fleet with the aim to generate 70% of its sales with EVs by 2030.11 Additionally, BMW via its charging service is partnering with various CPOs offering access to more than 120,000 charging points in Germany.12

While the European and American automobile producers are currently facing high competition from their Chinese counterparts, the pricing pressure might normalize the hikes of recent years and improve the economics of EVs vs. classical combustion vehicles, driving further EV growth.13

Demand significantly outweighs supply for charging station build-out

Since the EV market is growing rapidly, the charging infrastructure must grow – at least – proportionally as well. However, the current installation rate is not keeping up with the steep EV market growth and the ACEA (2022) estimates that the pace of public charging instalments in Europe must accelerate nine-fold to reach required charging points by 2030, generating great market potential for all stakeholders involved.14 Using numbers by the “Bundesnetzagentur” (per September 2023)15 and the “Umweltbundesamt” (per March 2023)16, there is also high demand in Germany, where for each fast charging station there are c. 49 EVs compared to a ratio of c. 1:1717 in China.

To achieve the ambitious goals of a rapid charging infrastructure expansion, governments are putting incentive schemes in place. For example, the German government introduced the “Deutschlandnetz” to ensure a nationwide, demand-oriented, and user-friendly fast-charging infrastructure.

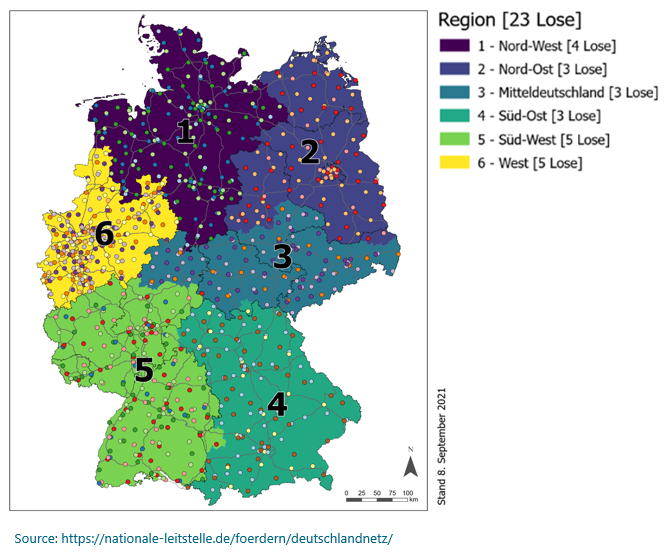

Figure 2: Overview of regional lots of the Deutschlandnetz18

The Deutschlandnetz is to be understood as an auction that the German government set up to allocate 900 sites from six regions via various “lots” as depicted in figure 2. Several companies participated and ten companies were granted the right to build and operate charging points on the assigned lots, namely Allego, BayWa, E.ON, Eviny, EWE, Fastned, Mer, Pfalzwerke Gruppe, TotalEnergies and VINCI.

The objective is to eliminate white spots and to create a broad charging network. These incentives set up by policy bodies are poised to narrow the gap between EV charging supply and demand with a structured ramp-up of the charging infrastructure.

At least two consolidation waves expected in fragmented EV charging market

Due to the appealing growth dynamics and access to capital in the last years many new players have entered the market. It is estimated that in Germany the top ten players in the EV charging sector have a less than 20% combined market share, while the rest of the market is highly fragmented.19 Alternating current (“AC”) and direct current (“DC”) charging thereby comes with lower entry barriers given stations are less capital-intensive and easier to install than in the high-performance charging (“HPC”) space.

For the AC/ DC charging segment, we share and support Constantin Schwaab’s vision of a horizontally consolidating sector. As the founder of Wirelane outlines: “We want to become the number one integrated service provider and CPO for AC/ DC charging in Germany and next to growing organically we intend to expand through targeted acquisitions in the German market.”For its M&A growth efforts, Wirelane raised €11 million of capital in 2023 and already acquired a CPO in the AC segment.20

One company active in the HPC segment is Charge Construct, a project development company in the high-power charging segment headquartered in Ingolstadt, Germany, offering the full service spectrum around the HPC station build-up from planning and civil engineering works to installation. The goetzpartners Corporate Finance team advised the shareholders of Charge Construct on the sale to the advanced clean energy Group (“ace Group”), a newly founded full-service partner for renewable energy solutions. The ace Group is an investment company of the Munich based growth investor EMERAM.

Below are some of our key learnings from the transaction and general observations from recent investor discussions:

- Market opportunity: The transition of the mobility sector to EVs creates huge demand for charging infrastructure. The market will need to reach a minimum penetration with charging stations swiftly. However, the build-up will continue beyond this point.

- Growth fuelled by public subsidies: The current stage of development is marked by substantial public funding, with the Deutschlandnetz program alone receiving a total of €1.8 billion in subsidies for the construction of HPC stations.21 However, subsidies for the purchase of EVs, which indirectly influenced the charging market, have expired due to a ruling by the Federal Constitutional Court and short-term savings in the 2024 federal budget.

- Market structure CPOs and need for consolidation: C. 20% of the CPO market is dominated by utilities and other large players; the remainder of the market is characterised by early-stage companies. There is strong pressure on these smaller players to consolidate due to the significant capital need for establishing charging infrastructure. This will create opportunities for those willing to take the lead in the consolidation. Initially, consolidation will not be driven by utilities and other large players, such as infrastructure funds, since company sizes are still too small.

- Developer of EV charging stations and related infrastructure projects: CPOs require development capabilities for EV charging stations which are typically provided by third parties. The respective developers are also well suited to participate in the build-out of other infrastructure (solar, glass fibre etc.). Those other infrastructure projects require similar capabilities in planning, civil engineering and installation as EV charging projects. We may soon see cross-sector developers.

- Emerging service market: Infrastructure will need servicing in future. There is a market opportunity for professional service firms providing services to CPOs. The respective providers may also develop into cross-sector companies. However, these providers must adhere to strict safety standards as they are servicing the high voltage grid infrastructure.

- Power pricing and EV charging: Clients are currently not very price sensitive and focused more on the availability of charging stations. This will change with a maturing network of charging stations. The need for competitive pricing, professional power purchasing and possibly trading will increase. Currently the factor of competitive power pricing is underestimated by market participants. Eventually CPOs may either become integrated by utilities or buy respective expertise from third parties.

goetzpartners is proud to have advised on the sale of Charge Construct to the ace Group in the exciting market environment and will be happy to support other aspiring companies in the growing field of EV charging. Adrian Zierer, Co-Founder of Charge Construct GmbH, was satisfied with the outcome of the M&A process and said: “As one of two Co-Founders of the company, I am very happy that with goetzpartners we had the perfect M&A advisory at our side for us and for the deal. The mix of M&A and e-mobility expertise was the key to a maximally successful transaction. Together, we managed to tap into the extremely broad investor market of strategic and financial investors and convince them of our capabilities.”

Authors:

Jan-Hendrik Röver, Managing Director, Co-Head of Energy & Infrastructure (Email)

Matthias Volk, Director, Energy & Infrastructure (Email)

Josefine Boehm, Christian Harms

Sources:

[1] Science Magazine, 2022

[2] Copernicus, 2024

[3] European Commission, 2023

[4] Our World in Data, 2024

[5] European Commission, 2020

[6] European Automobile Manufacturers’ Association, 2022

[7] Shell, 2024

[8] bp, 2024

[9] EnBW, 2023

[10] Mercedes-Benz, 2023

[11] Volkswagen, 2024

[12] BMW Charging, 2024

[13] Handelsblatt, 2024

[14] European Automobile Manufacturers’ Association, 2022

[15] Bundesnetzagentur, 2023

[16] Umweltbundesamt, 2023

[17] Sustainability by numbers, 2023

[18] Nationale Leitstelle Ladeinfrastruktur, 2024

[19] Apricum, 2023

[20] Silicon canals, 2023

[21] Electrive, 2022