Private Equity

Consulting

We do not state the obvious. We explore the target’s core to provide meaningful assessments for your successful investments.

Our Service Offering

goetzpartners Private Equity Consulting is the leading partner in the mid-cap private equity industry. Recognized at eye-level as a respected sparring-partner, we give our clients, such as investors and shareholders, confidence with respect to core questions regarding buy, hold and sell strategies. We accompany our clients throughout the entire investment life cycle – from the initial target approach, the client’s decision of the right investments with a fair valuation perspective, to identification and implementation of the company’s true value, as well as a value-maximizing exit.

Our Value Proposition

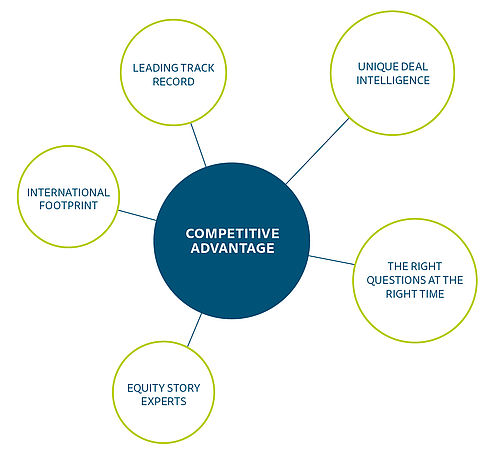

COMPETITIVE ADVANTAGE

With a leading track record as the trusted advisor of numerous strategic and financial investors, goetzpartners has proven to provide its clients with a compelling competitive advantage along the entire investment life cycle. Therefore, our private equity consulting team is often the first choice of private equity funds in front-running deals around the world and across multiple industries.

We deliver a unique deal intelligence at an early stage through extensive market sounding and close interactions with key stakeholders. By leveraging sound market insights and deep industry expertise, complemented by a wide network of experts, we provide answers to the most pressing due diligence questions early in the process. With our ability to identify the key drivers of a business model and to develop a tangible equity story, we help our clients maximize their portfolio value during the holding period and in the exit planning process.

Integrated full service

Our uniquely integrated full-service offering enables us to deliver a coordinated deal team with fast information flow, minimal yield loss and highly efficient alignment in the form of a convenient one-stop. This makes goetzpartners the preferred partner for all key issues and questions in buy-side and sell-side transactions for many financial and strategic investors:

- Our Private Equity Consulting team works closely with our clients to answer their most pressing questions related to any commercial, operational or technical aspects. We support clients in gaining transparency on markets, competitive dynamics and business plan achievability; assessing a target’s full potential for smart deal decision-making; defining and executing truly value enhancing measures for portfolio companies and finally identifying the optimal exit strategy to achieve investors’ returns.

- Our M&A team offers clients a secure foundation for various types of transactions, such as buy- and sell-side situations, carve-outs or fundraisings providing valuable advice regarding efficient process execution, valuation matters, expert networks as well as support and coordination throughout the entire process.

More about our M&A team - Our Debt Advisory team provides objective advice on optimal debt structures, sources of funding and terms of financing, thereby helping to leverage the success of our clients’ transactions.

More about our Debt Advisory team

Exceptional Insights

goetzpartners understands the specific needs of private equity companies and delivers a setup which allows us to meet the high requirements optimally, quickly, pragmatically and as a respected eye-level sparring-partner.

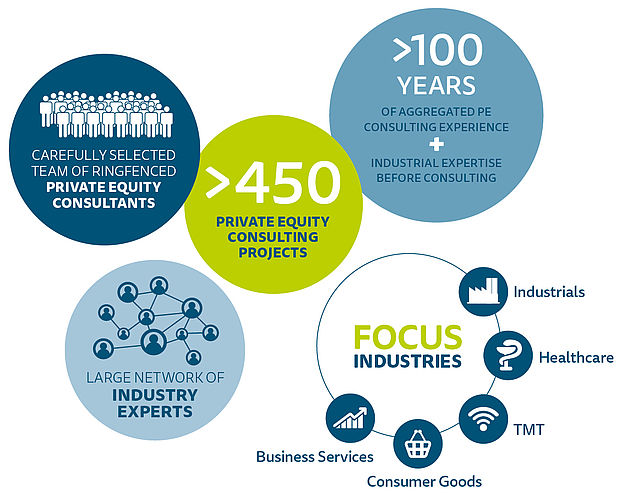

Our setup includes:

- A carefully selected team with extensive industrial and operational experience acquired over many years.

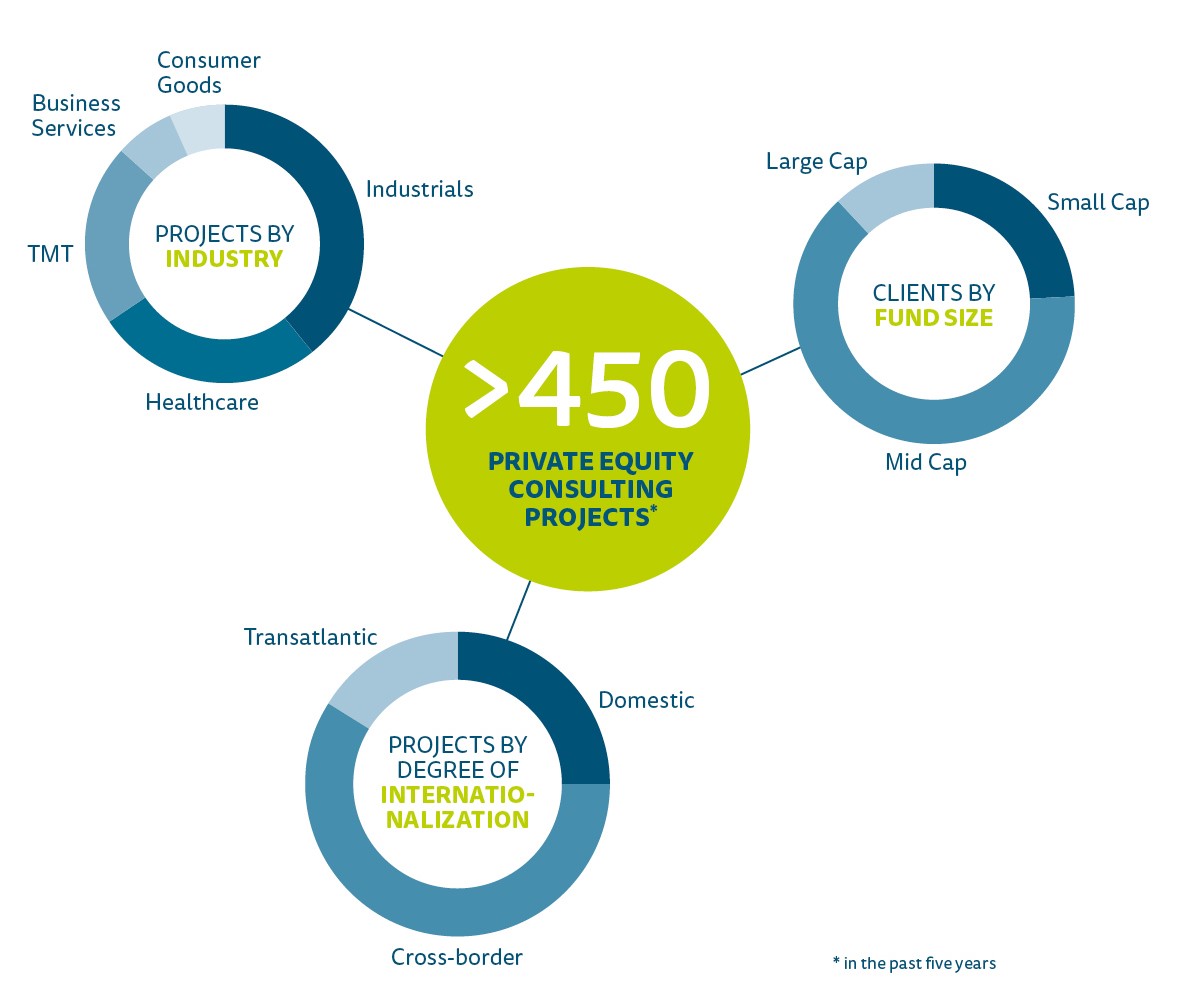

- A vertical team structure with dedicated industry specialists and a large network of dedicated industry experts which provides reliable answers for critical and industry specific questions. Our private equity expertise mainly covers Industrials, Healthcare, TMT, Business Services and Consumer Goods. More about our sector expertise

- Substantial methodological tools to generate in-depth insights, including a wide set of data bases, a variety of different survey methods, comprehensive bottom-up and top-down market modelling, sensible management questioning and many out-of-the-box thinking methodologies, to mention only a few.

Key facts and figures

Latest transactions Private Equity Consulting

-

(value not disclosed)goetzpartners advised Liberta Partners with aCOMMERCIAL DUE DILIGENCEon its investment in Negotiation Advisory Group

(value not disclosed)goetzpartners advised Liberta Partners with aCOMMERCIAL DUE DILIGENCEon its investment in Negotiation Advisory Group -

(value not disclosed)goetzpartners advised Arcus Infrastructure Partners with aCOMMERCIAL DUE DILIGENCEon its investment in EINHUNDERT Energie GmbH

(value not disclosed)goetzpartners advised Arcus Infrastructure Partners with aCOMMERCIAL DUE DILIGENCEon its investment in EINHUNDERT Energie GmbH -

(value not disclosed)goetzpartners advised Management of Impact Acoustic AG and Verium AG with aCOMMERCIAL DUE DILIGENCEon its investment in Impact Acoustic AG

(value not disclosed)goetzpartners advised Management of Impact Acoustic AG and Verium AG with aCOMMERCIAL DUE DILIGENCEon its investment in Impact Acoustic AG -

(value not disclosed)goetzpartners advised Deutsche Invest Capital Solutions with aCOMMERCIAL DUE DILIGENCEon the acquisition of Iconia Group

(value not disclosed)goetzpartners advised Deutsche Invest Capital Solutions with aCOMMERCIAL DUE DILIGENCEon the acquisition of Iconia Group -

(value not disclosed)goetzpartners advised EMZ Partners with aCOMMERCIAL DUE DILIGENCEon its investment in H&Z Management Consulting

(value not disclosed)goetzpartners advised EMZ Partners with aCOMMERCIAL DUE DILIGENCEon its investment in H&Z Management Consulting -

(value not disclosed)goetzpartners advised Verdane with aCOMMERCIAL DUE DILIGENCEon the acquisition of HQ Equita and its portfolio

(value not disclosed)goetzpartners advised Verdane with aCOMMERCIAL DUE DILIGENCEon the acquisition of HQ Equita and its portfolio -

(value not disclosed)goetzpartners advised CONSTELLATION CAPITAL with aCOMMERCIAL DUE DILIGENCEon the acquisition of Solar Wiebe GmbH & Co. KG

(value not disclosed)goetzpartners advised CONSTELLATION CAPITAL with aCOMMERCIAL DUE DILIGENCEon the acquisition of Solar Wiebe GmbH & Co. KG -

(value not disclosed)goetzpartners advised Afinum 9 with aCOMMERCIAL DUE DILIGENCEon the acquisition of Hofstetter PCB AG

(value not disclosed)goetzpartners advised Afinum 9 with aCOMMERCIAL DUE DILIGENCEon the acquisition of Hofstetter PCB AG -

(value not disclosed)goetzpartners advised Hawle Beteiligungsgesellschaft m.b.H. with aCOMMERCIAL DUE DILIGENCEon the acquisition of Erhard Group

(value not disclosed)goetzpartners advised Hawle Beteiligungsgesellschaft m.b.H. with aCOMMERCIAL DUE DILIGENCEon the acquisition of Erhard Group -

(value not disclosed)goetzpartners advised Aspire Education Group, majority-owned by EMZ Partners, with aCOMMERCIAL DUE DILIGENCEon the acquisition of WEKA Group's education division

(value not disclosed)goetzpartners advised Aspire Education Group, majority-owned by EMZ Partners, with aCOMMERCIAL DUE DILIGENCEon the acquisition of WEKA Group's education division -

(value not disclosed)goetzpartners advised Vidia Equity on theACQUISITION & CDDof Best Plastic Management GmbH

(value not disclosed)goetzpartners advised Vidia Equity on theACQUISITION & CDDof Best Plastic Management GmbH -

(value not disclosed)goetzpartners advised Tikehau Capital with aCOMMERCIAL DUE DILIGENCEon the acquisition of CReators of the Outside WorlD (“CROWD”)

(value not disclosed)goetzpartners advised Tikehau Capital with aCOMMERCIAL DUE DILIGENCEon the acquisition of CReators of the Outside WorlD (“CROWD”) -

(value not disclosed)goetzpartners advised Ronal Group on theACQUISITION & CDDof Kudos Shower Products Limited

(value not disclosed)goetzpartners advised Ronal Group on theACQUISITION & CDDof Kudos Shower Products Limited -

(value not disclosed)goetzpartners advised Deutsche Invest Capital Solutions with aCDD & ACQUISITION FINANCINGon the acquisition of GLOBOGATE concept AG

(value not disclosed)goetzpartners advised Deutsche Invest Capital Solutions with aCDD & ACQUISITION FINANCINGon the acquisition of GLOBOGATE concept AG -

(value not disclosed)goetzpartners advised the Management with aCOMMERCIAL FACT BOOKon ifb SE

(value not disclosed)goetzpartners advised the Management with aCOMMERCIAL FACT BOOKon ifb SE

goetzpartners advised Liberta Partners ("Liberta") with a Commercial Due Diligence on its investment in Negotiation Advisory Group ("NAG"), a leading consultancy for negotiation management based in Mannheim, Germany.

goetzpartners advised Arcus Infrastructure Partners LLP ("Arcus") with a Commercial Due Diligence on its investment in the EINHUNDERT group of companies ("EINHUNDERT"), a leading provider of solar-based tenant electricity solutions.

goezpartners advised Management of Impact Acoustic AG and Verium AG with strategic advice and a Commercial Due Diligence as part of Verium's investment in Impact Acoustic.

goetzpartners advised Deutsche Invest Capital Solutions GmbH ("DI Capital Solutions") with a Commercial Due Diligence for the acquisition of Iconia Group AG ("Iconia"), a Swiss-based company that provides B2B customer engagement services for the global luxury industry.

goetzpartners advised EMZ Partners ("EMZ") with a Commercial Due Diligence on its investment in H&Z Management Consulting (“H&Z”), a leading consultancy for global value chain management.

goetzpartners advised Verdane with a Commercial Due Diligence of Muegge GmbH as part of its acquisition of HQ Equita.

goetzpartners advised CONSTELLATION CAPITAL with a Commercial Due Diligence on the acquisition of Solar Wiebe GmbH & Co. KG ("Solar Wiebe"), a leading provider of roof-top photovoltaic (PV) planning and installation services attractively located in North Rhine-Westphalia.

goetzpartners advised Afinum 9 with a Commercial Due Diligence on its investment in Hofstetter PCB AG (Hofstetter), the leading European provider of printed circuit boards plating and special final finishing services.

goetzpartners advised Hawle Beteiligungsgesellschaft m.b.H. ("Hawle") with a Commercial Due Diligence on the acquisition of Erhard Group ("Erhard"), a renowned valve manufacturer based in Heidenheim, Germany.

goetzpartners advised Aspire Education Group ("Aspire Education"), a privately operated education group in the German-speaking region majority-owned by EMZ Partners ("EMZ"), with a Commercial Due Diligence on the acquisition of WEKA Group's education division ("WEKA"), a leading education platform comprising five media and continuing education companies with locations in Switzerland and Germany.

Marking its initial platform investment in the plastic recycling space, Vidia Climate Fund I has acquired specialized plastic recycling company Best Plastic Management GmbH (BPM) through newly established PolymerCycle GmbH.

goetzpartners advised Tikehau Capital ("Tikehau") with a Commercial Due Diligence on the acquisition of CReators of the Outside WorlD (“CROWD”), a pan-European leading provider of cycling infrastructure and sustainable street furniture based in the Netherlands.

goetzpartners was mandated as exclusive M&A and Commercial Due Diligence advisor by leading global wheels manufacturer RONAL AG (“RONAL Group”) and its 100% subsidiary SanSwiss AG (“SanSwiss”) on the acquisition of Kudos Shower Products Limited (“Kudos” or “Kudos Group”), a UK-based manufacturer of shower enclosures and trays.

goetzpartners was mandated by DI Capital Solutions as debt advisor on the acquisition of GLOBOGATE concept AG.

goetzpartners advised Management of ifb SE with a Commercial Fact Book on the sale of ifb, an international finance and risk transformation and compliance consultancy, headquartered in Grünwald, Germany.

Contact

Gerrit Bückins

Principal

Management Consultants

Giovanni Calia

Managing Director

Management Consultants

Italy

Filippo Cerrone

Partner

Management Consultants

Italy

Philip Lloyd

Principal

Management Consultants

Italy

Axel Meythaler

Managing Director

Management Consultants

David Oesterschlink

Principal

Management Consultants

Alexander Reitmann

Partner

Management Consultants

Dr. Gerrit Schütte

Managing Director

Management Consultants

Michele Zanin

Partner

Management Consultants

Italy