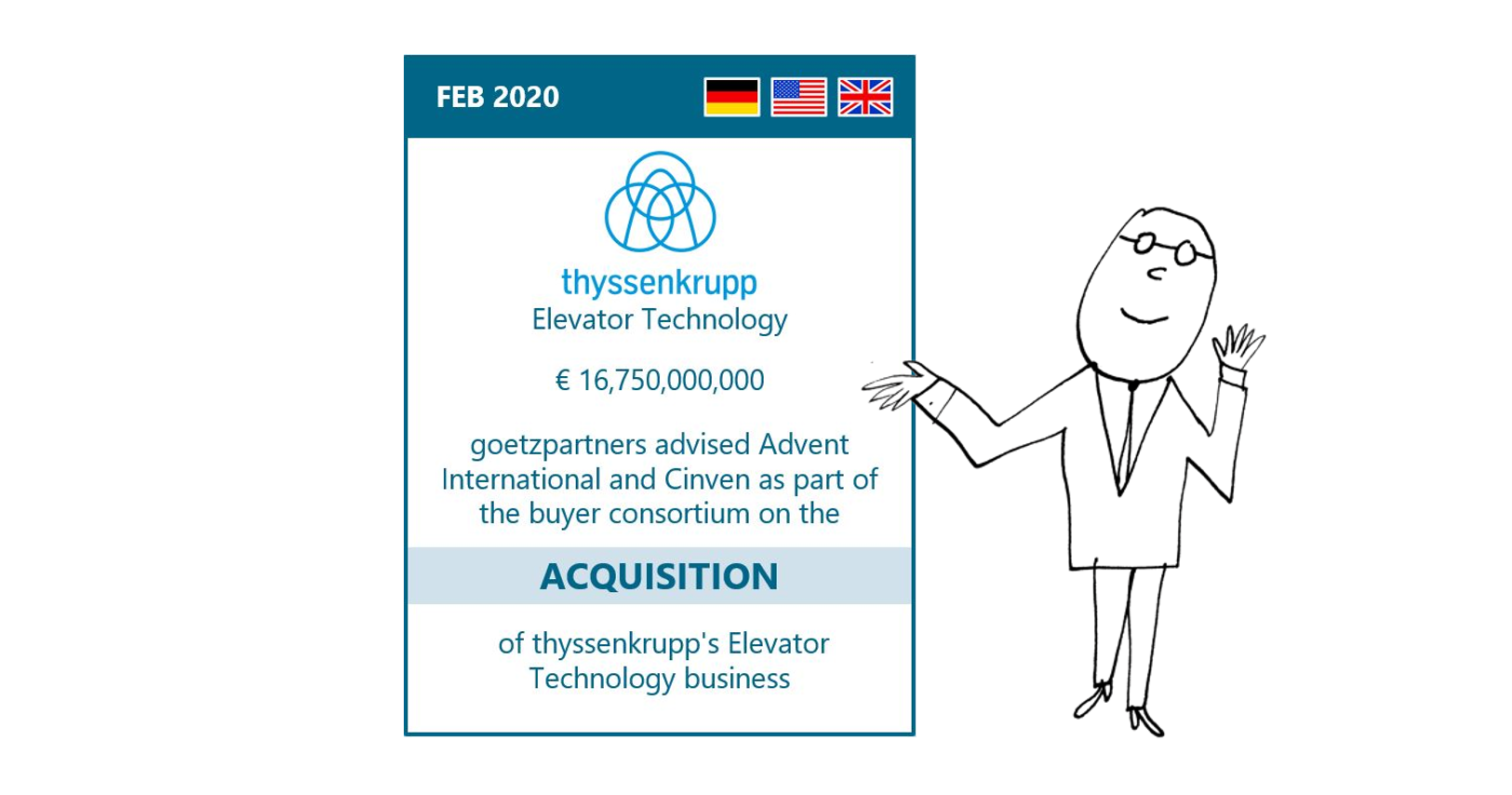

goetzpartners advised Advent International and Cinven as part of the buyer consortium together with RAG-Stiftung on the acquisition of thyssenkrupp’s Elevator Technology business

goetzpartners advised the international private equity firms Advent International (“Advent”) and Cinven who together with the RAG-Stiftung (together “the consortium”) acquired thyssenkrupp’s Elevator Technology Business (“thyssenkrupp Elevator”). As part of the transaction, thyssenkrupp AG will reinvest in thyssenkrupp Elevator and will acquire a substantial minority stake, underlining the attractive value creation potential of the business as well as a commitment to Germany and the Group’s employees. This transaction creates an independent global market leader, renowned for innovation and technology. The consortium, with long-standing heritage in Germany, industry expertise, global network and capital resources has established a long-term value creation plan supported by investment in market expansion, product innovation and add-on acquisition opportunities.

“thyssenkrupp Elevator has established itself as an international market leader, with a strong and innovative product portfolio. We look forward to working alongside Cinven and RAG-Stiftung to leverage our collective expertise and capital resources and to build on this excellent platform for further growth, thereby creating a strong, independent industrial company”, said Ranjan Sen, Managing Partner and Head of Germany at Advent.

“Cinven is delighted to invest in and accelerate the growth of thyssenkrupp Elevator both organically and through further acquisitions. Further investment in product development, R&D and international expansion will enable us to grow the business sustainably over the long-term,” said Bruno Schick, Partner and Head of DACH and Emerging Europe at Cinven. “Alongside Advent and RAG-Stiftung, we look forward to partnering with management to shape the next phase of this outstanding business.”

The transaction is expected to close by the end of the third quarter of 2020, subject to customary closing conditions and regulatory approvals.

goetzpartners Corporate Finance acted as financial advisor in this transaction, further underlining our competence in advising on international and industry shaping M&A deals.

ABOUT ADVENT INTERNATIONAL

Founded in 1984, Advent International is one of the largest and most experienced global private equity investors. The firm has invested in over 350 private equity transactions in 41 countries, and as of September 30, 2019, the firm had $56.6 billion (€51.9 billion) in assets under management.

ABOUT CINVEN

Founded in 1977, Cinven is a leading international private equity firm focused on building world-class European and global companies. With a track record spanning more than 30 years, Cinven’s focus is on delivering attractive returns to its funds’ investors by driving value creation in the companies in which the funds invest. Cinven funds have invested in over 130 companies, and the firm currently has €23bn in assets under management.

ABOUT THYSSENKRUPP ELEVATOR

thyssenkrupp Elevator is a leading international provider of elevator technology with operations in more than 1,000 locations worldwide. Headquartered in Germany, the Group generated revenues of €8.0bn in the financial year 2018/2019. thyssenkrupp Elevator provides innovative solutions to customers in more than 100 countries. Its product portfolio includes passenger and freight elevators, escalators and moving walkways, passenger boarding bridges, stair and platform lifts as well as a customised service business including maintenance of its entire product portfolio. The business operates a global sales and service network to ensure optimum proximity to its customers.