Article

The FiberCo era: powerful differentiation strategies to stay ahead

More and more FiberCos are popping up in the marketplace, their eyes fixated on this or that particular part of the fiber value chain. Capital markets are handsomely rewarding this specialization push, too. There is just one problem: Most FiberCo players are giving very little thought to future differentiation strategies. What can FiberCos do to seize growth opportunities and strengthen their market position in the future?

The emergence of FiberCos

Traditionally, integrated telco operators covered the entire value chain as they acted in a very heterogeneous environment. But the job of covering all steps in this value chain (from infrastructure to products and customer service) is getting increasingly more challenging. Consequently, telco operators often split themselves up: A ServCo will focus on customer-facing functions (e.g., go-to market and sales), and a FiberCo will concentrate on the upstream portion of the value chain (e.g., construction and maintenance of passive infrastructure).

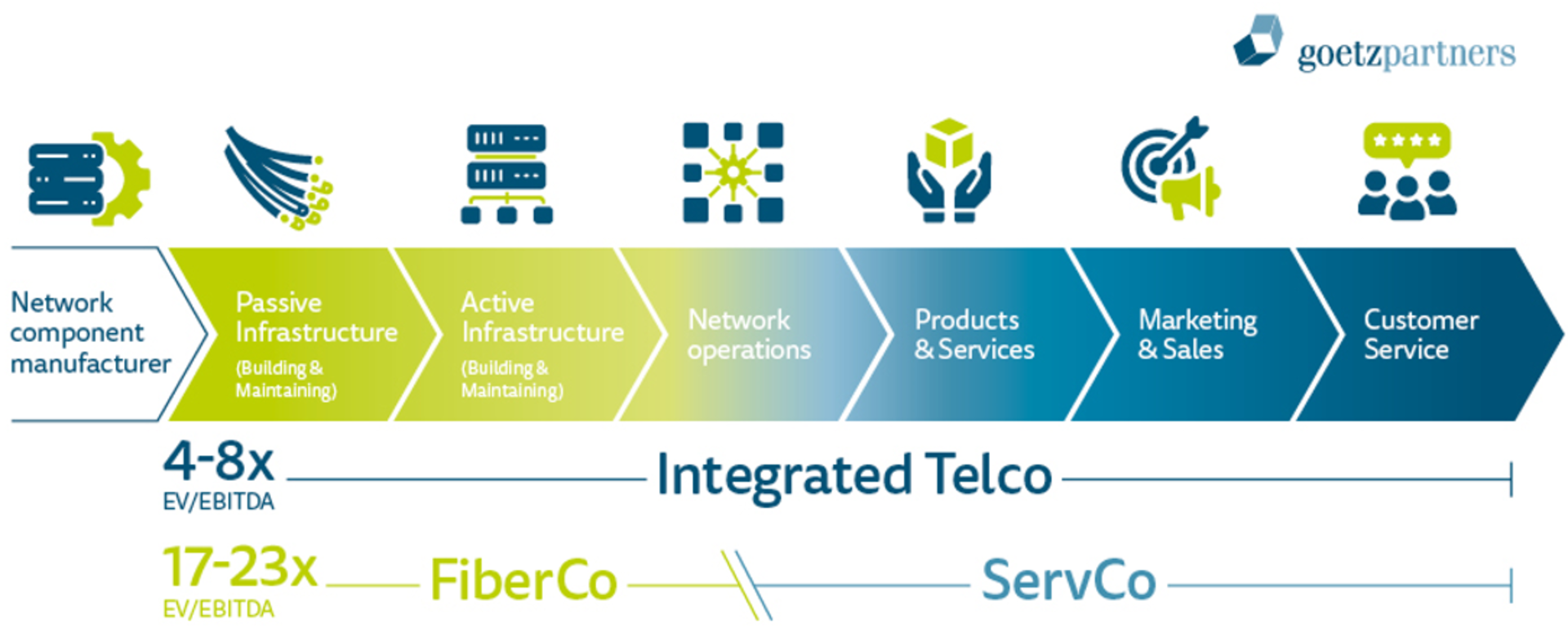

Capital markets are rewarding companies that specialize in parts of the telecommunication value chain. A quick look at the numbers shows how: Telecom operators are valued at four to eight times their EBITDA. By contrast, infrastructure players are valued at 17 to 23 times their EBITDA (see figure 1). These hefty valuations are based on a range of factors as more specialization facilitates greater OPEX efficiency with higher standardization of operations. Furthermore, higher asset utilization can be achieved by engaging with several different Internet service providers (ISPs) as wholesale clients. Last but not least, FiberCos are a handy vehicle that investors can use to gain access to predictable cash flows over longer periods of time (10 to 15 years).

Exemplary setup of FiberCos along the fiber value chain (Figure 1)

Due to public pressure on infrastructure expansion within European states, the European market has moved to the forefront of this push, and the first signs that this trend will translate globally have begun to appear. However, one question is lingering in the air: Are FiberCos already tapping their full potential from this emerging business model, or are they failing to develop the differentiation strategy that they will need to stake out their positioning in the future?

Value-driven differentiation strategies

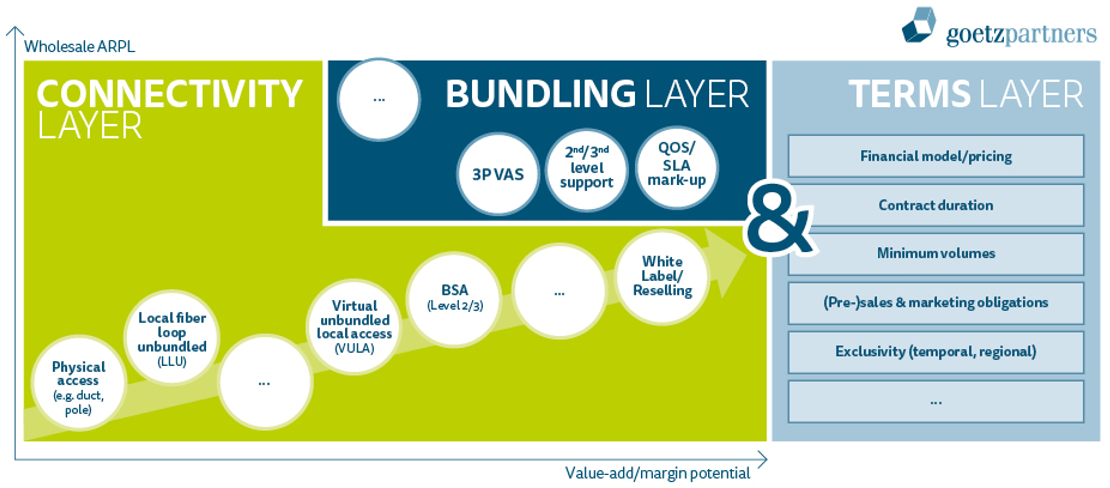

As the fiber value chain in Figure 1 shows, FiberCos come in all sorts of set-ups. From there, we move to Figure 2, which outlines three clusters for differentiation within the wholesale portfolio: connectivity layer, bundling layer and terms layer.

Exemplary differentiation opportunities within wholesale portfolio (Figure 2)

Connectivity layer

The core objective is to provide connectivity that caters to the specific needs of retail ISPs that have different infrastructure requirements and value-adds. The connectivity layer provides companies with several approaches they can us to carve out their own special home in the marketplace: from providing only physical access (e.g., ducts or poles) to offering virtual unbundled local access (VULA) or white label products to ISPs and other customers. Most of the time, though, expansions in the connectivity layer come with a trade-off, as higher margin potential often comes with higher complexity. As a result, a FiberCo must clearly place its overall strategy focus on future developments.

One approach appears to be particularly promising: the option of offering virtual unbundled local access. When aligned with the overall strategy, this approach could pay off handsomely because all ISPs can access and use the active physical infrastructure, a step that would eliminate the need for a large proportion of separate physical installations of equipment for each ISP. Another potential way for companies to set themselves apart from competitors is to offer white label products. Municipal companies, for example, will be able to incorporate fiber products into their existing product portfolio without the need for specialized fiber skills and knowledge. In addition, FiberCos could develop suitable vertical solutions based on their white label product. Developing these solutions for clients with specific customer needs and thus enabling wholesalers to broaden their product portfolio could be a vast wellspring of future revenues (e.g., connectivity solutions to health-tech clients focusing on remote surgery/telesurgery).

Bundling layer

The goal of the bundling layer is to create revenue and margin uplifts for the purpose of driving wholesale and B2B2C stickiness by offering value-added services (VAS). All actions within the bundling layer can be used to drive average revenue per line (ARPL) and increase the margin of the basic connectivity service.

One way for a company to expand would be to bundle third-party VAS in its own product range. One potential third-party VAS that could boost B2B2C stickiness could be the offering of MS365, online storage or OTT services. However, offering additional services to wholesale clients (ISPs) are also another way to drive margins (e.g., second- and third-level network support).

Terms layer

The terms layer is hardly applied for differentiation purposes when a company is building an wholesale portfolio. In particular, it provides an opportunity to create a match with ISPs’ retail business and ensure marketing & sales orchestration. An individualized offer can be drawn up in several different ways. These include offering minimum volumes to wholesale clients or having

(pre-)sales obligations for all involved parties. As nearly 67% of gross adds are realized before the end of construction work, clear (pre-)sales obligations are an important lever for successful FiberCos. One final promising idea is to grant certain exclusivity rights (e.g., temporal, regional) that can strengthen the business relationship with wholesale clients and their market positioning.

Summary

The FiberCo era is only getting started. The framework described in this article can be used to quickly identify areas for potential improvements and help FiberCos create their mid- to long-term strategic alignment. All exemplary differentiation strategies must be evaluated in the light of the FiberCos individual structure and setup to ensure an overall strategic fit. Applying this approach will help FiberCos strengthen their positioning in the market and unearth sources of future revenues.

Authors:

Dr. Nima Ahmadi, Partner (Email)

Jeremias Fessler, Julian Hermanutz, Felix Poeschel